If you want a big pay rise in Hong Kong or Singapore in 2019, you probably need to be a data scientist. Hiring of data scientists by the likes of Standard Chartered, JP Morgan and DBS will be even stronger than in 2018, say, recruiters, adding that local skill shortages are worsening.

Standard Chartered alone currently has 33 vacancies in Singapore and Hong Kong requiring data skills. Our previous analysis of DBS’s online jobs found that 42% of its total tech openings demanded big data expertise. Above all, these banks and their rivals want to hire more data scientists into both business divisions and standalone data teams.

“The hiring spree for data science experts will continue this year in Hong Kong and Singapore,” says Janice Sham, a managing consultant at recruiters Ambition in Hong Kong. “Banks’ main emphasis until recently was cost-cutting and offshoring their back offices – but now their main priority in the two cities is utilizing big data to power business decisions and enhance banking applications.”

Alix Randriana, a senior consultant in technology at recruiters Space Executive in Singapore says building a team that turns huge data sets into actionable insights has become essential for banks. Data scientists use customer data to create personalized marketing campaigns, says Randriana. They can also apply data science methods to detect suspicious activities and fraud.

How do you get a data science job?

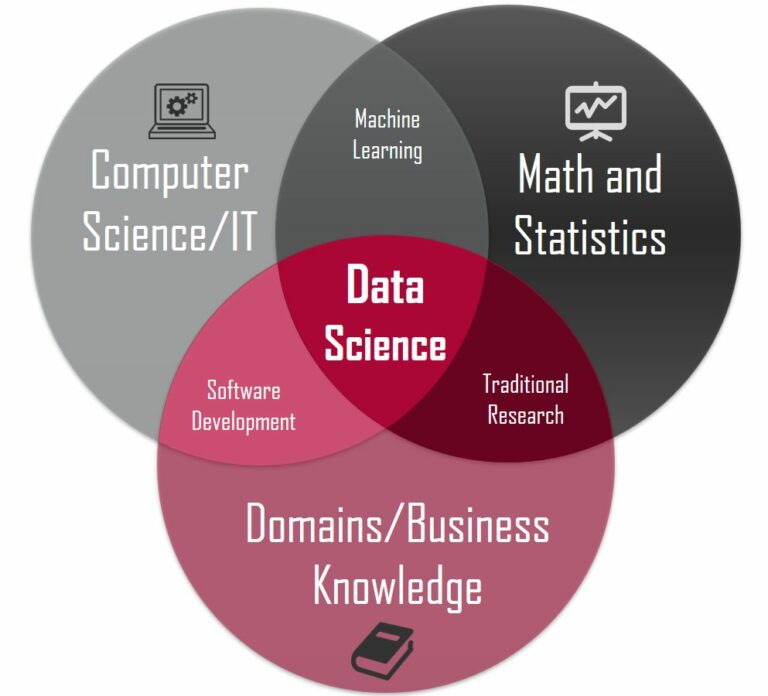

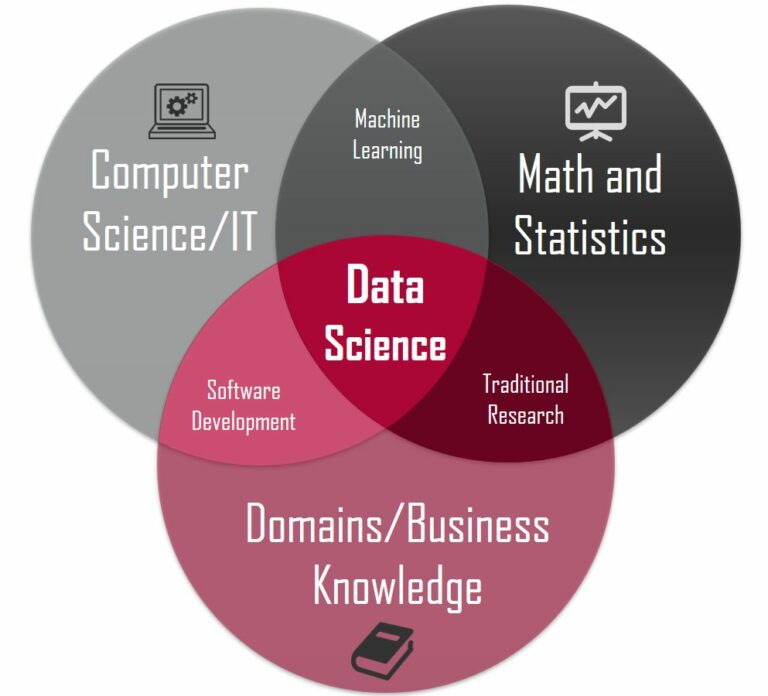

Banks want to recruit data scientists with degrees (a Master’s is considered a minimum) in subjects such as computer science, applied mathematics or statistics, says Randriana. You will also need a “language-agnostic programming skill set”, including fluency in Python or R, and knowledge of big data tools such as Hadoop, MongoDB, Spark, and Cassandra, she says.

“Data scientists with experience of managing structured and unstructured data, as well as geo-fencing data to enhance consumer insights are in demand,” adds Samuel Dennis, an associate director at recruiters Hudson in Singapore.

Aside from purely technical skills, you’ll need commercial nous to get a data science job at a bank in Hong Kong or Singapore. “Large banks are looking to hire data scientists who are able to find commercial opportunities and solve business challenges,” says Dennis.

Banks in Hong Kong and Singapore are now struggling to find enough data scientists to fill their vacancies. The surge in demand for these professionals is a more recent phenomenon in Asia than it is in the West and the local talent pool is small, say recruiters.

Pay rises for new joiners regularly top 20% as a result. For a vice president data scientist in Hong Kong, for example, this type of increase could mean an extra HK$200k (S$35k) a year. VPs in the function earn about HK$990k on average, according to our salary table for banking tech jobs.

“Talent shortages this year mean banks’ doors will be open to data science experts coming from outside the finance industry,” says Sham from Ambition.

It won’t be easy, however, to poach data scientists from the corporate sector, especially from the likes of Alibaba, Google and Grab. Over the past year, the reverse trend has been in play – large tech firms have been taking on technology employees from banks at regular intervals in Singapore and Hong Kong.

Jobs at banks aren’t necessarily that attractive for data scientists. Writing on this website earlier last week, one data scientist complained of antiquated tech, long hours and a “rigid organizational hierarchy” when working for a bank. He’s since moved to a biotech firm and works 9 am to 5.30pm on a “far more advanced technology stack”.

Source: efinancialcareer – Simon Mortlock