We at Asia Bankers Club along with our partner, Cult Wines, are always striving to diversify the investment portfolios of our members, if you’d like to learn more about wine investment recommendations, its growth and ROI, please contact us now and we’d be happy to assist further.

Executive Introduction

2018 was a slow year for Bordeaux, with muted growth and fewer opportunities. Focus continues to broaden with further diversification in the wine market. With US and “emerging“ markets experiencing growing demand, more wines from these regions are now being traded on Liv-ex –the global trading platform for fine wine.

Our research on US and emerging wine markets revealed several interesting facts, including the following trends:

- Next to Burgundy, Chile and US are the two fastest-growing regions with consistent returns.

- CW Chile Index has returned an attractive CAGR of 13.24% since its inception on September 2011.

- Californian wines have proved to provide higher returns, with Opus One and Screaming Eagle leading the gains.

- Fine wine market exposure to New World wines is becoming more mainstream as distribution channels widen and global demand rises.

- New vintage allocations for top US wine producers are already becoming challenging for investors.

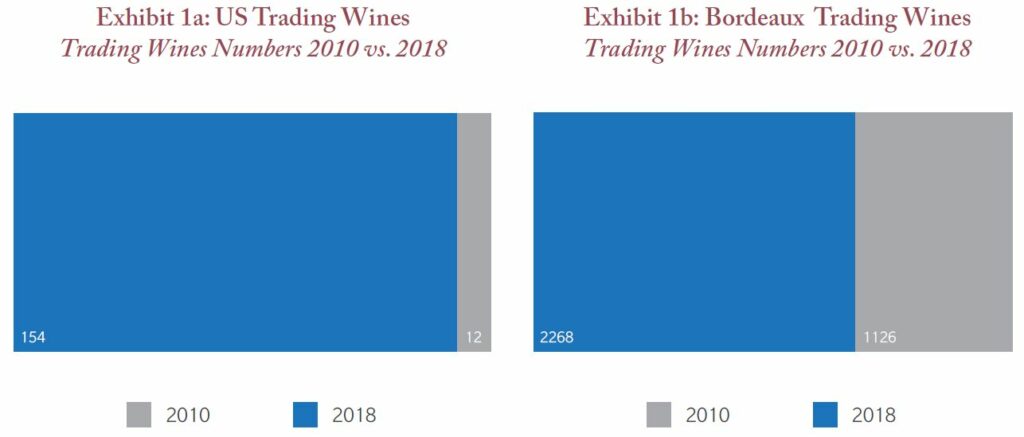

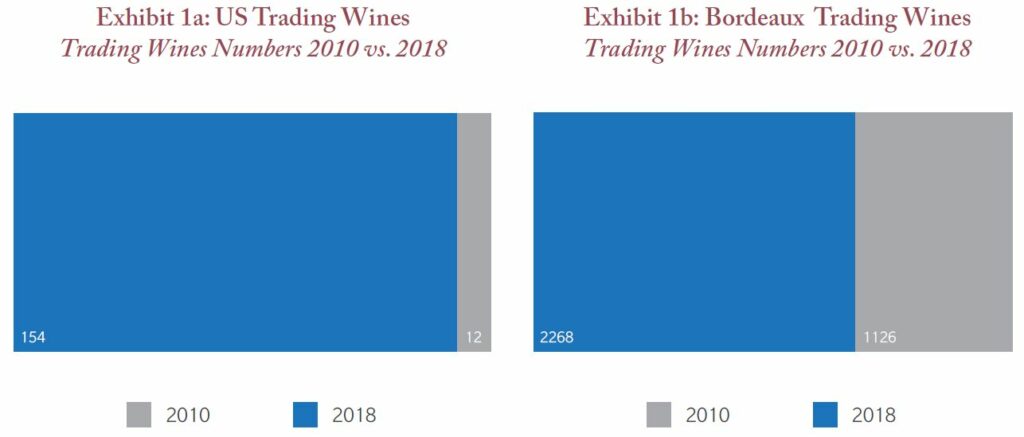

In 2010, there were only 12 US wines traded on Liv-ex. By the end of 2018, that number had risen to 154. To make sense of the general trend in the wine market, whilst over 90% of the wines that traded on Liv-ex were from Bordeaux in 2010, they now represent only 55% of trade and wines from the rest of the world are catching-up. Particularly with the US market, the fast-growing number of wines on the trading platform has captured investor’s attention and may signal promising prospects ahead.

In 2018, Liv-ex officially launched the California (CA) 50 index as the region has taken an increased share of the wine market. Since its inception,back in 2003, the California 50 index climbed 219.8 %. The biggest name in the US – Screaming Eagle – has significantly contributed to this performance. This upward trend suggests that the fine wine market is more than ready to embrace the growing demand for US wines as the need for diversification is fast becoming a priority for investors.

From our research, we think that one of the factors for increased confidence in US wines is the growing number of ways wineries/producers interact with their clients and potential investors. Joining a mailing list used to be virtually the only way to get allocation in the US fine wine market. Today, as more wines from both US and emerging markets are trading on the secondary market, investors can gain access to the most sought-after wines. This also helps explain the popularity and performance in recent years of a few ‘unicorn’ high-growth US wine producers and the impressive returns of the region.

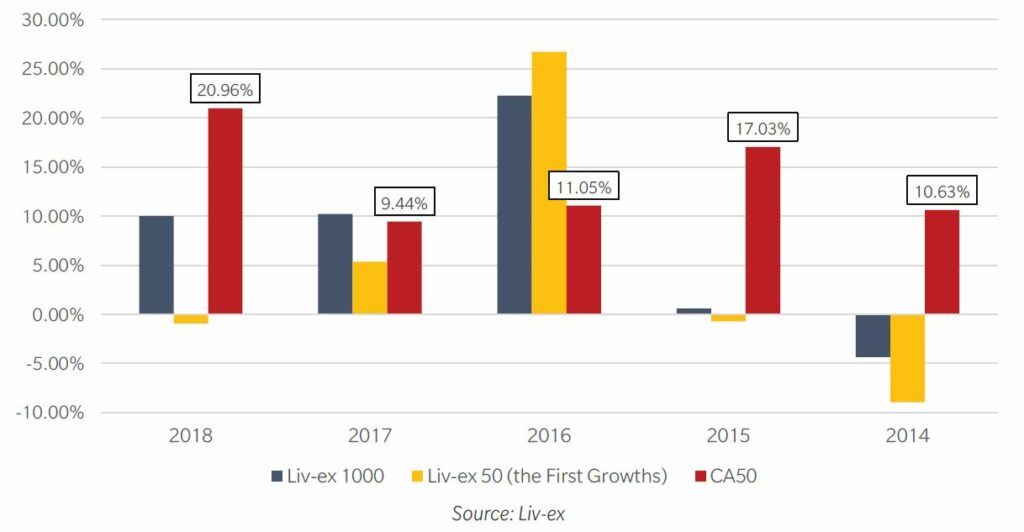

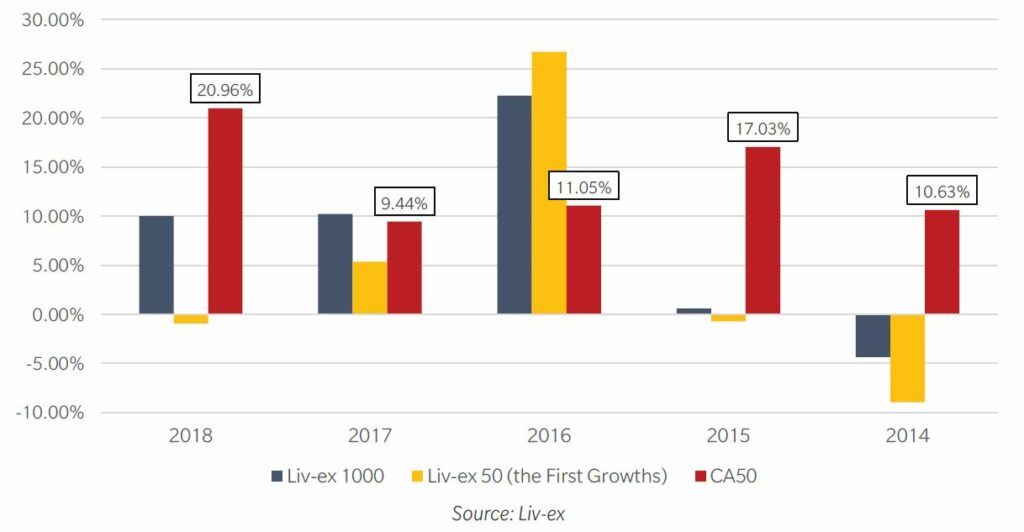

Taking a closer look at the annual growth rate for sub-region indices within Liv-ex 1000 – the broadest measure of the fine wine market, it’ s interesting to note that in 2018 the existing trend accelerated, the CA 50 index outpacing the other sub-regions with an annual return of 20.96%. Although only publicly launched in May 2018, the CA 50 components can be tracked back to 2003.

We found that Liv-ex’s CA 50 has delivered positive returns for five consecutive years since 2014 with an average 5-year return of 13.82%, outperforming both Bordeaux 500 and Liv-ex 50, which tracks the Bordeaux First Growths. The buying trend is primarily due to collectors sophisticated taste and better knowledge of the ultra-high-end, boutique producers across California and becoming more open to investing in New World wines.

Diversification is an important rationale and investors are therefore starting to pay more attention to the emerging regions of the wine market. Last year prices for Bordeaux wines were growing at a slower pace than five years ago and regions like US and Spain have shown potential. Investing in wine has long meant buying wines of top estates in Bordeaux. However, the current trend is showing a more diverse wine market.

Exhibit 2: Annual Performance %

California and First Growth Bordeaux

In the wine business, earning a place on the wine list of a Michelin-star restaurant is quite an achievement, but it is the trend behind the buyers “search “patterns leading to restaurant listing that we are mostly keen to understand. A survey conducted by Wine-lister showed that Napa Valley dominates searches for US wines, and Opus One dominates searches for Napa. The brand is hugely popular in Asia and jumped to the No.1 spot of popularity for US wines, achieving 147% more restaurant presence across China, Singapore and Taiwan than its worldwide average.

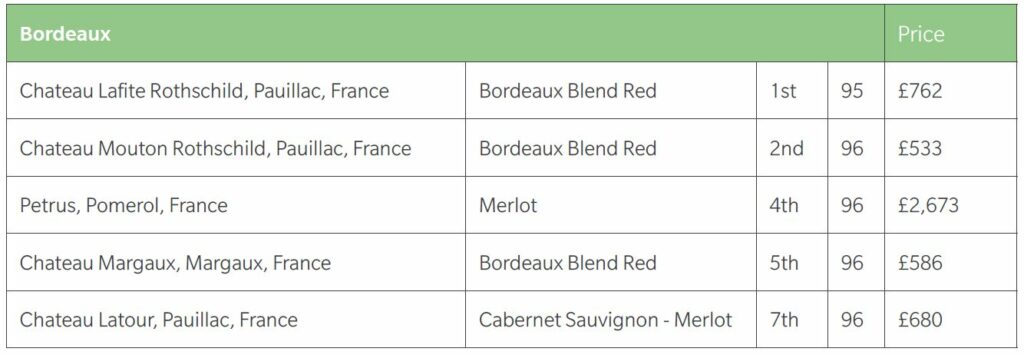

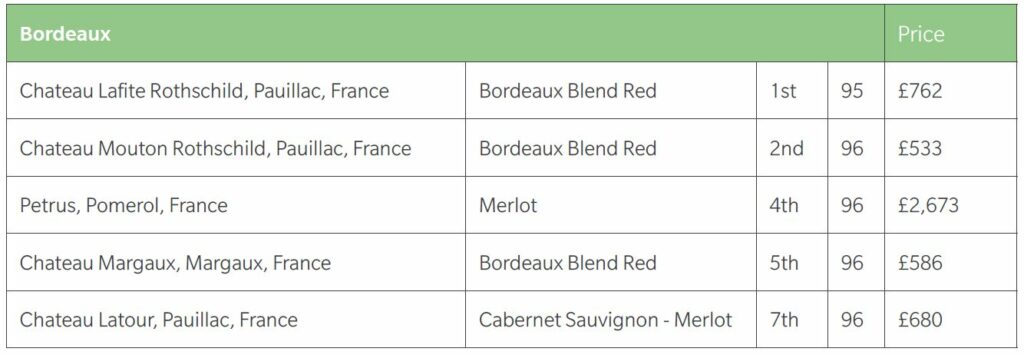

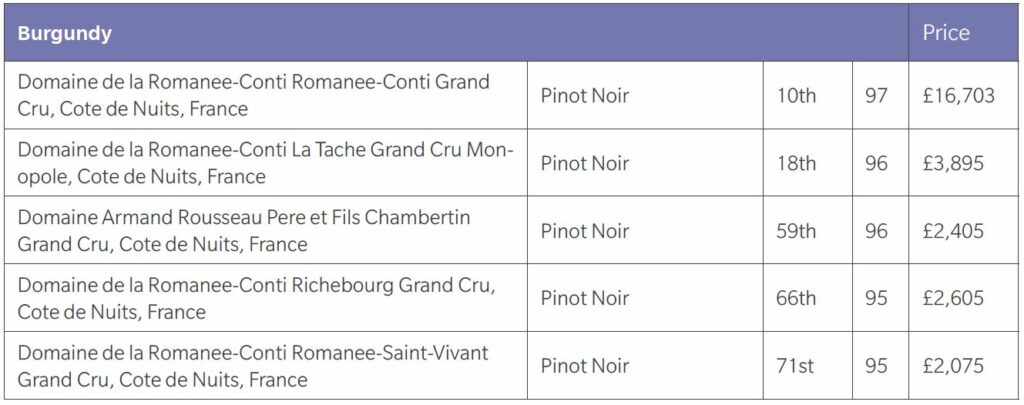

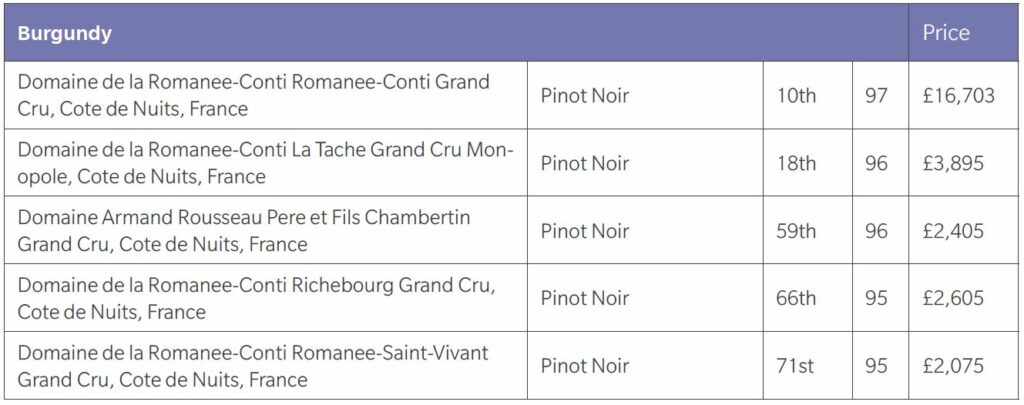

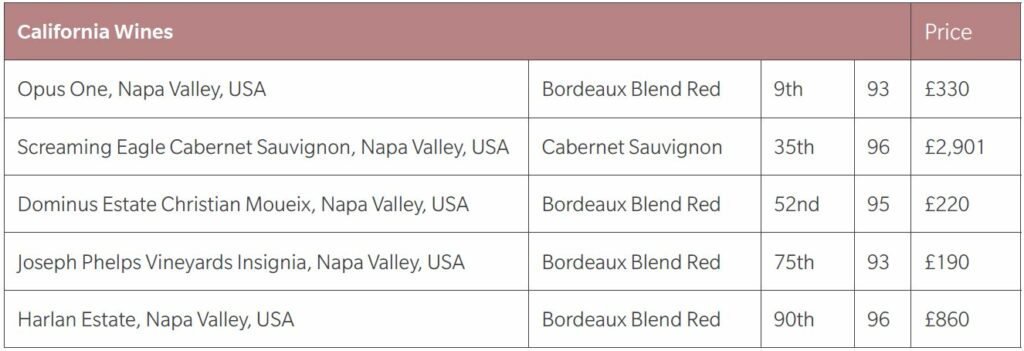

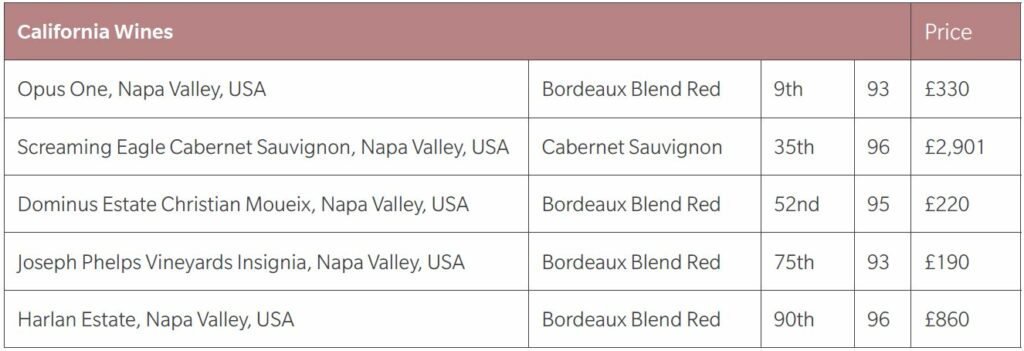

A detailed analysis of the search patterns on Wine-searcher helped us identify the shift in both consumer taste and investment focus, revealing strategic moves for investors. This prompted us to compare market price and score for the top 5 wines based on searching popularity (in Wine-Searcher) from three important wine regions – Bordeaux, Burgundy and California, to establish which region offers better value for money.

It is interesting that California stands out as the region with the highest relative value advantage. (Exhibit 3). With an average score of 94.6, the top 5 popular wines from California priced at an average of £900 per bottle, offered good value when compared to Burgundy’s top 5 wines, whilst some wines such as Domaine Romanee Conti trading at around £16,000 per bottle. For investors seeking relative value, California shows great potential.

Exhibit 3: Relative Value Analysis

Most sought after wines among Bordeaux, Burgundy and US

The fine wine market is fast becoming more diverse and the number of wines traded on the secondary market has increased considerably. For investors, rapid price growth is what stands out for wines from emerging markets. There is certainly evidence of more wines from these new regions being well-received not just by wine critics and connoisseurs but also by the secondary market.

Further diversification from established regions is gaining popularity and emerging markets are becoming more prevalent. How should investors respond to these new forces to develop their investment strategy for the next few years?

Allocation in these regions has become the new challenge. Some prestigious vineyards in US publicly indicated they felt pressure in fulfilling the increased demand after their most recent vintages sold out in a matter of hours after release. Today, these well-respected vineyards are prepared to change their allocation approach, which might result in a new relationship between investors and producers, in response to the changing market conditions. This has created opportunities for more investors to access the market with greater transparency.

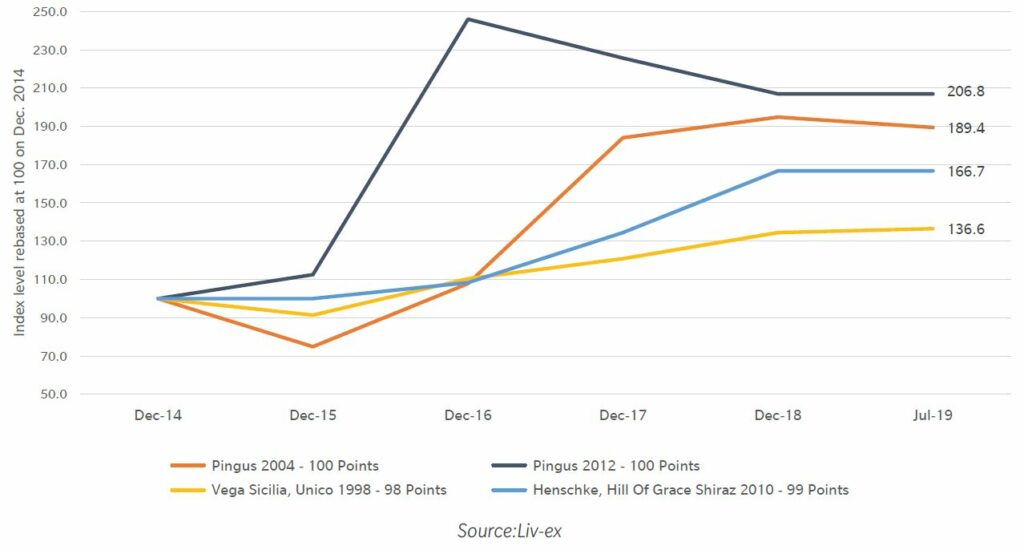

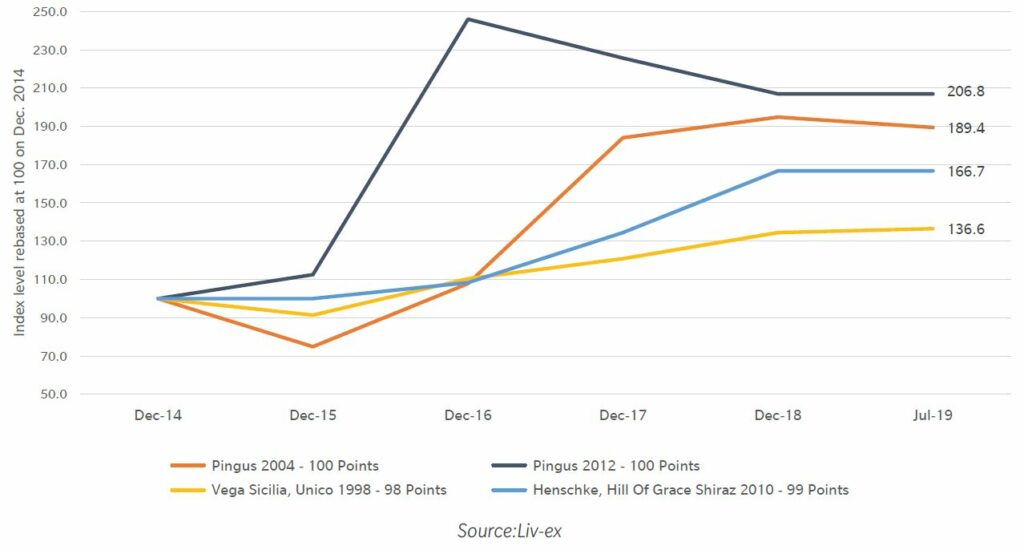

Away from US, the great names of Australia and Spain are doing well too, with the wines of Penfolds, Henschke and Pingus all performing, especially the latter. Since the end of 2016, the price of Pingus 2012, which was awarded 100 points by the Wine Advocate, has doubled to reach £925 per bottle. Pingus’ other prime vintage, 2004 also doubled in value over the last five years. Pingus 2004 was awarded 100 point by Wine Advocate in 2010. (exhibit 4)

Exhibit 4: Selected Wines from the Emerging Market

Spain & Australia

Klein Constantia Vin de Constance, a sweet wine from South Africa, also deserves a special mention with its best-rated vintages 06 and 07 returning over 50% in five years. Only produced in exceptional vintages, Egon Muller, a renowned estate in Germany, lived up to its hype, with some of its rare TBA sweet wines made from Riesling priced at an average £11,000 per bottle, up from £7,000 only two years ago. Turning to Chile, Sena, Almaviva and Clos Apalta have done particularly well in the last few years on the secondary market.

In conclusion, the market’s developments are underpinned by fundamental changes and trends – such as the need for further diversification, the hunt for value and the shift in consumer taste. All of these factors indicate a promising future and fuel growing confidence for emerging market wines as an investment. We suggest that investors seeking better returns allow for a tactical allocation of 5% to 10% of their portfolio to emerging market wines depending on their risk profile.

The Producers

Iconic Californian Producers

- Opus One

- Screaming Eagle

- Dominus

- Harlan Estate

- Ridge Monte Bello

Iconic Producers of Emerging Wine Regions

- Almaviva – Chile

- Penfolds – Australia

- Vega Sicilia – Spain

Tier One Producers of US and Emerging Wine Regions

- Pingus – Spain

- Mondavi Chadwick Seña – Chile

- Vérité – US

- Joseph Phelps – US

- Henschke – Australia

- Torbreck – Australia

- Clarendon Hills – Australia

Rising Stars of US and Emerging Wine Regions

- Realm Cellars – US

- Cardinale – US

- Continuum – US

- Concha y Toro Don Melchor – Chile

- Clos Apalta – Chile

- Clos Rougeard – Loire Valley, France

- Cheval des Andes – Argentina

Sweet Wines: New trends

- Klein Constantia (Vin de Constance)

- Egon Muller

*Please note that there are varying amounts of reliable price data across the range of producers featured in this report. We have producer profiles on all the wines listed above but not featured in this report and these are available upon request.

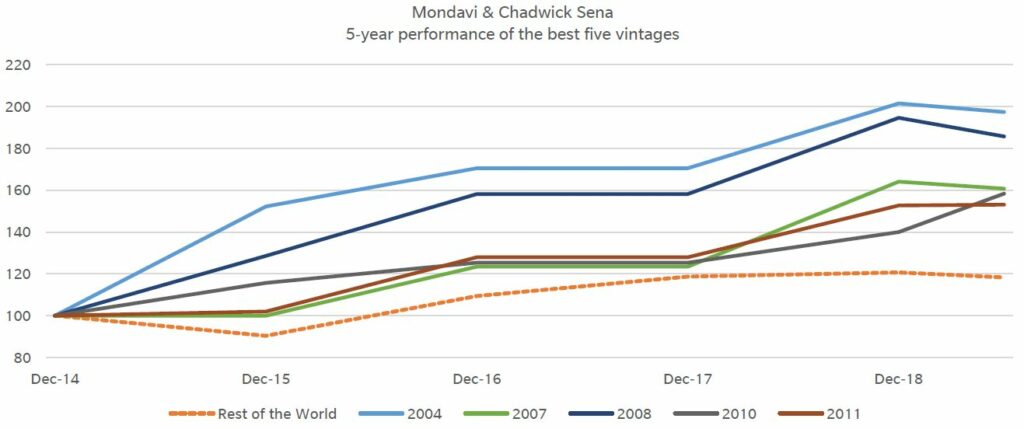

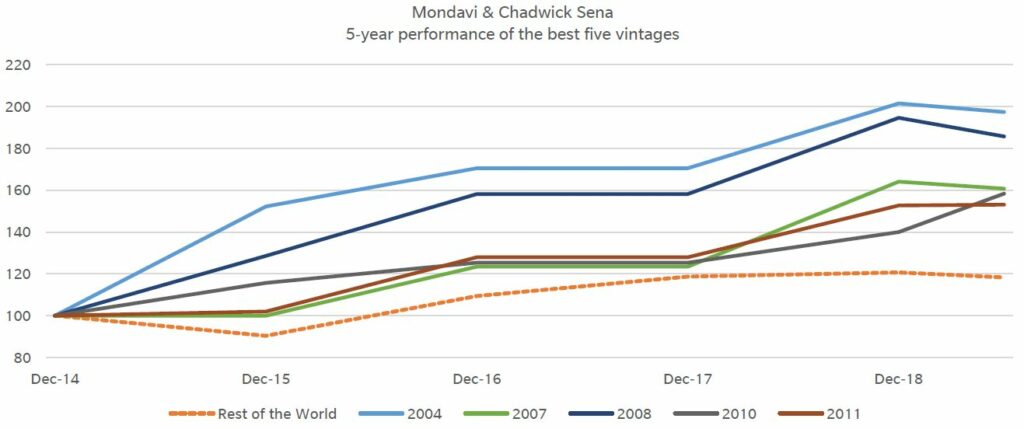

Example Profile: Mondavi & Chadwick, Sena

The Judgement of Paris, in 1976, catapulted Californian wine onto the international scene, making a name for top producers of Napa Cabernet. The lesser known Judgement of Berlin, in 2004, began the renaissance for its Chilean counterparts – lined up against Lafite, Latour and Chateau Margaux, both Vinedo Chadwick and Sena claimed the two top spots in the tasting.

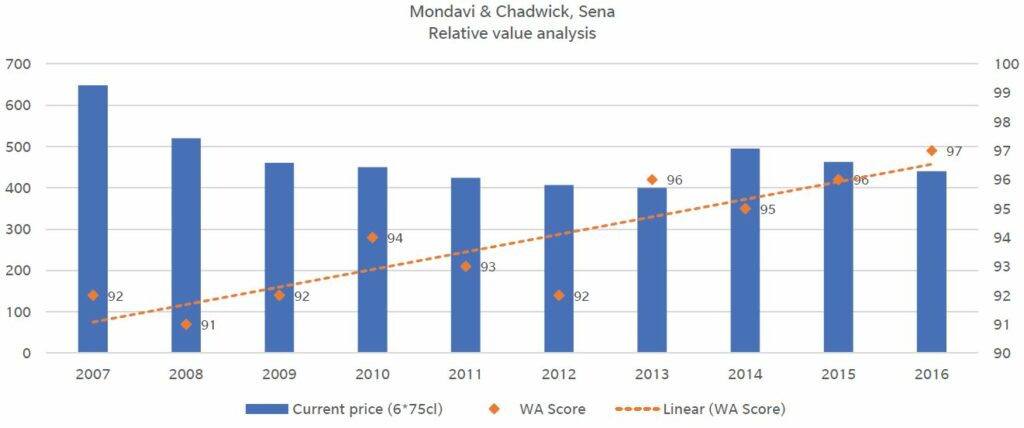

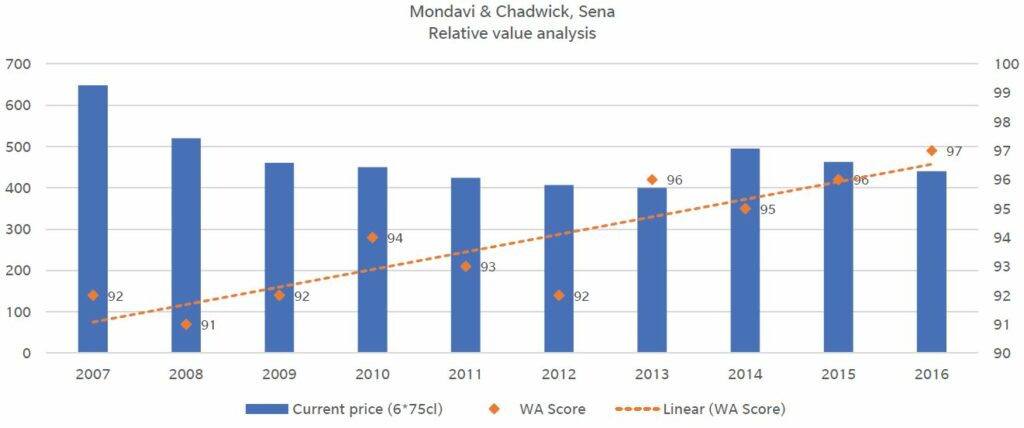

Californian wine, over the last 10 years, has risen to represent some of the most expensive in the world, rivalling any of the greats from France. Chile is now poised to do the same, with Vinedo Chadwick, the top scorer in the Berlin tasting, now trading for over £200 per bottle. Looking beyond this, we bring you Sena, made by the same estate and a partnership between Eduardo Chadwick, the leading light in Chilean viticulture, and Robert Mondavi – arguably Napa’s biggest name, and the man who created Opus One in conjunction with the Rothschilds.

Unlike Chadwick, Sena is a far more modest third of the price, with recent vintages consistently receiving the same critic scores- we have isolated it as a pricing inconsistency which is primed to change. Labelled ‘Chile’s first ever icon wine’ by Decanter and credited with changing the landscape of the entire Chilean wine industry, it was the first to not only compete in quality with great Bordeaux, but also call it to light through this high-profile partnership.

With the first vintage created in 1995, the vineyard site was chosen to harness the cooling pacific breeze, in the same way as Napa Valley, to create a wine with finesse and freshness, whilst taking full advantage of the ripe Chilean sun. This is one of the ultimate representations of a wine on the rise. Producing a very ‘first growth’ esq 10,000 cases per year, the five most recent vintages of Sena have scored over 95 points as they tweak the formula. This new shift toward top scores from The Wine Advocate will inevitably lead to increased interest and price rises.

Sweet Wines: New trends

- Best performing 2004 vintage returned + 97%

- Average 5-year performance across vintage since 2000 + 41%

- Average WA scores of recent 10 vintages – 94 points

US and Emerging Market Report

Part Two: Producers

Stay tuned next month for Part Two of this report, available next month on our website and newsletter. If you’d like a copy, please contact us here.

This expansion of the US and Emerging Market Report covers detailed views of Cult Wines recommended wines and producers, with historical performance and vintage comparison analytical views, this document will be a ‘must read’ for those looking to sink their teeth into the US and Emerging Markets as an investment opportunity.